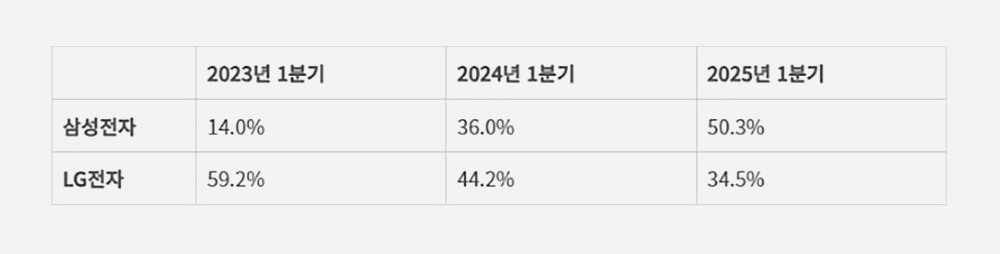

In just a few years, Samsung has managed to rise to first place in the American [abc]Oled[/abc] TV market, like other segments of the TV market (Mini [abc]LED[/abc], Lifestyle, Smart TV, etc.). Of course, this is a snapshot of the first quarter of 2025 and does not prejudge the final result on December 31, 2025. However, the dynamic is clearly in favor of Samsung (see the figures below) with a gap that already appears difficult to bridge for the second.

US Oled TV market, why Samsung overtook LG££££

This dominant position in the USA is explained by the strength of the Samsung brand of course, leader in the global TV market in 2024 for the nineteenth consecutive year (see our news TV market 2024: Samsung global leader for the 19th consecutive year), but also by consumer sentiment: Samsung [abc]Oled[/abc] TVs are perceived as superior thanks to more efficient image processing and above all a more efficient AI interface compatible with the brand's smartphones and tablets.

At a time of increased convergence between the different screens in a home (TV, smartphone, tablet, computer), LG is therefore paying for its failure in the smartphone market recorded in 2021 with the closure of its mobile phone division. Another problem identified by Omdia is the increasingly hostile attitude of American consumers towards the sale of their personal data collected by the webOS system of LG Smart TVs.

US Oled TV market, zoom in on market shares££££

In 2023, LG held 59.2% of the LG Oled TV market (by volume), 44.2% in 2024 and 34.5% in the first quarter of 2025. For its part, Samsung had a 14% market share in 2023, 36% in 2024 and 50.3% for the first three months of 2025. In Europe, LG is still the leader of the Oled TV market, which represents 55.5% of the global Oled TV market compared to 20% for the United States. Zooming in further on the figures for the first quarter of 2025, we see that LG holds a market share of 56.4% in Europe for a total of 391,100 units.

Oled TV market, is Samsung's growth a problem for LG Group?££££

The evolution of the Oled TV market in the United States in favor of Samsung, and probably soon in Europe, is not so problematic for LG Group. Indeed, if LG Electronics sales decline, a significant proportion of Samsung Oled TVs vintage 2025 are equipped with Woled and Oled Primary RGB Tandem panels signed LG Display. What LG Group loses on one side, LG Group gains on the other. It is also true, the profitability for LG Group remains stronger on an LG Electronics TV sold compared to a Samsung TV with an LG Display Oled panel sold. This argument, however, needs to be adjusted based on the number of TVs sold, with LG Display able to make up for lost sales through the strength of the Samsung brand. We'll see you at the end of 2025 for a full assessment.