No need to go back to the figures for the Oled TV market in 2022 and 2023, just click on the link above to learn about its depressing situation. As for the consequences mentioned at the end of our previous post concerning the main players in Oled, the manufacturers on the one hand and their customers on the other, they are now tangible.

Development of QD Oled technology slowed££££

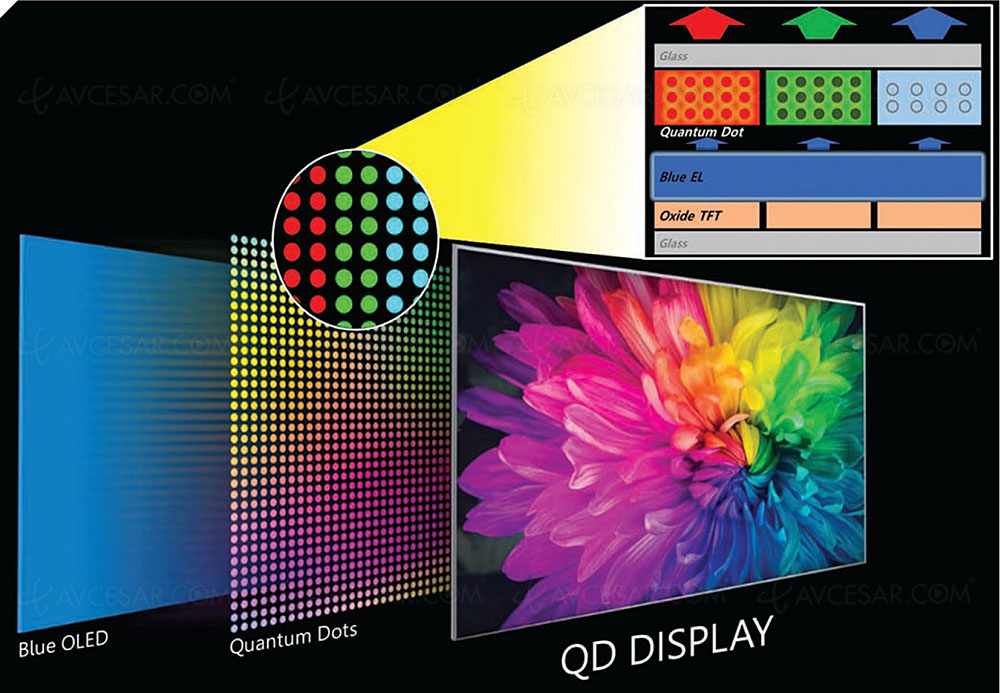

First of all, we can cite Samsung Display's refusal, last November, to invest further in QD Oled technology, particularly in the development of 8K Ultra HD Oled TV panels, by returning to the sender Kativa the QD Oled inkjet printing equipment provided for this purpose. Given the weak growth prospects for the Oled TV market for the years to come, the Korean group has in fact decided to suspend part of the development of its QD Oled technology, preferring on the one hand to optimize the performance of its current production lines , favoring on the other a five-year agreement with LG Display for the supply of 5 million White Oled panels with diagonals of 42'' (107 cm), 48'' (122 cm), 77'' (196 cm) and 83' ' (211 cm) (see our news Oled/LCD TV agreement Samsung and LG Display, it's signed for 5 years!). Participant in a global contract with LG Display, also including the annual purchase of 5 to 8 million LCD TV panels (Samsung wishes to drastically reduce its purchases of LCD panels from the Chinese BOE with which the Korean group is in dispute at the level of several patents), this supply of White Oled panels saves Samsung from massive investments to increase the number of its QD Oled panel production lines. Indeed, if the leader of the TV market (for the 18th consecutive year in 2023 by the way) decides to invest in the Oled TV market segment, this mechanically induces a significant need for Oled panels: naturally or almost, Samsung will capture a Oled TV market share close to that occupied by LCD (admittedly, a little below given its late arrival on this technology and the evangelization work carried out by LG for 11 years now, which still logically removes the larger fruits). Samsung will therefore supplement its need for Oled panels at LG Display.

This choice of purchasing Oled panels from LG Display therefore proves to be a significantly less expensive solution in the medium/long term, especially considering that the White Oled/QD Oled Oled TV market will not really take off in the years to come, the fault is prices incapable of competing with those of QLED and QLED Mini LED TVs, and an expected future economic situation that is not very rosy. Samsung will also be more able to react to developments in the TV market to, for example, restrict its orders for Oled panels from LG Display, if necessary. Until then, the alliance of the two Korean giants to resist the Chinese has at least the merit of relieving the weight of the debt weighing on LG Display, of allowing it to envisage a brighter future and to continue to develop its White Oled process (as soon as the CES show in Las Vegas is in the rearview mirror, we are talking about the Oled 2025 TV range with a light peak around 4,000 nits for the most upscale models). Even if Oled TV sales are not expected to shine too much in the future, they should still progress. Relatively good news for LG Group.

The quality-price ratio more than ever in favor of Mini LED QLED and QLED Vs Oled££££

If the expected moderate development of the Oled TV market (and the TV market) for the next few years can be explained by a difficult economic situation, another reason is emerging in the analyzes of research firms and among brands: the growth of large diagonal LCD TVs and Mini LED QLED and QLED obedience, as well as their quality-price ratio . To summarize, a very large majority of consumers believe that the image quality of these televisions is now more than sufficient for their use. Why spend a lot more for a reduced quality gain? This is the question that the vast majority of consumers ask themselves. And when the need for a new TV arises, many buyers will choose an LCD broadcaster at a much more affordable price than an Oled specimen with an equal diagonal, others will choose in favor of a diagonal (many) larger for an equivalent price (see the TCL 115X95, 292 cm, pictured below). In short, the price element is totally on the side of the LCD.

Sony is developing its own Mini LED backlighting system££££

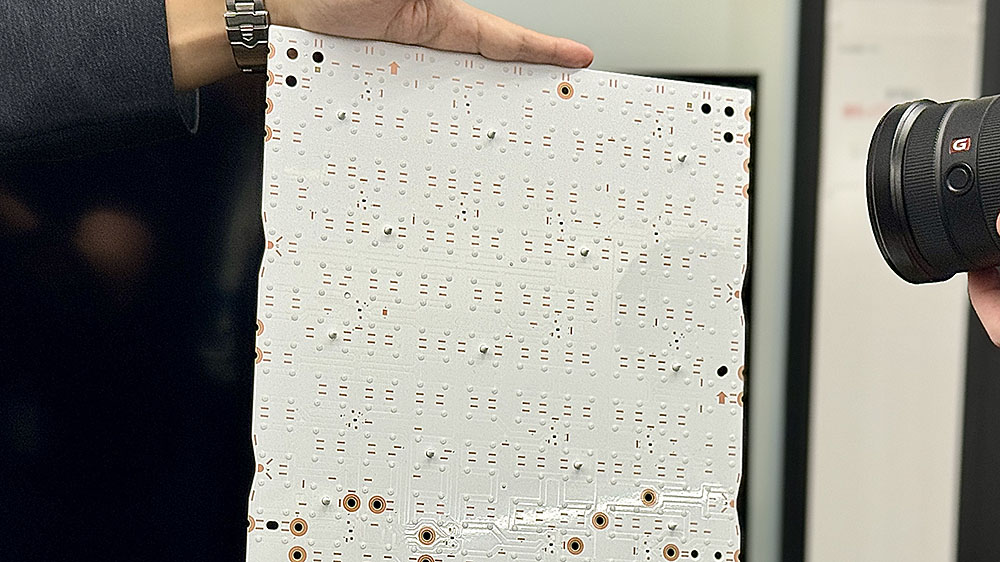

Another consequence of the difficulties encountered by the Oled TV segment since 2022, Sony decided in 2024 to once again favor LCD technology for its premium televisions with a new backlighting system of its own developed by its subsidiary Sony Semiconductor Solutions Group (see our Sony TV premium 2024 news, focus on Mini LED to the detriment of Oled? and photo below). The Japanese group undoubtedly shares the analysis of market research and analysis firms mentioned above. If the manufacturer remains involved in Oled, the Mini LED, which allows very large televisions to be included in its range at still affordable prices, becomes a priority again, unlike their Oled counterparts whose prices are soaring with the increase in diagonals. .

Oled screen manufacturers are now focusing on the IT market££££

Another trend linked to the sluggish Oled TV market over the last two years, the refocusing of Oled panel manufacturers towards the IT market. Contrary to Oled TV sales forecasts, those of Oled monitors and screens are in good shape with the development of teleworking and the renewal of screens for larger diagonal models within companies. Not to mention the increasingly important integration of Oled technology in laptops, in the next Oled iPads or even the rapid adoption by the gaming market of Oled Ultra Wide monitors (32/9). The news of Oled computer screens at the recent CES show in Las Vegas, with many new products presented or announced, perfectly illustrates this new situation.

Samsung Display has already started in March 2023 the construction of an Oled manufacturing line. 8.6th generation IT QD Oled screens (2250 x 2600 mm) by recycling an LCD line for an amount of $3.1 billion. For LG Display, the latest rumors see LG Display building an identical IT screen manufacturing line in its Paju factory in the space initially planned for additional Oled TV panel lines. This is a budget transfer between the large panel Oled TV P10 factory initially planned (see our news LG Display 10.5th generation Oled TV factory delayed to 2023 and photo below)) abandoned today , towards the monitors. This project should be officially announced by LG in the second half of 2024. Finally, the Chinese BOE has also just announced a significant investment to manufacture panels for monitors and computers. As we can see, the investments of Oled screen manufacturers are now oriented towards the IT world.

Oled TV market, a second wind coming with Ink-Jet Printed Oled technology?££££

Given all these movements within Oled screen manufacturers, manufacturers and TV brands, we have to wonder if the golden age of Oled TVs is already over. The answer is yes if we consider Oled technology dominating the TV market. The market share of current Oled televisions (White Oled and QD Oled) is undoubtedly destined to plateau, around 5% at best, in the years to come. And even if their quality-price ratio should improve over time, that of LCD Mini LED TVs should also, undoubtedly faster and more significantly with the multiplication of very large diagonals which will never be current (or so little) in Oled…

But we repeat, this reflection applies to Oled TVs equipped with White Oled or QD Oled panels which are expensive to manufacture. Oled RGB Ink-Jet Printed technology, developed by the Chinese giant TCL and announced to be extremely competitive in terms of production costs (see our CES 24 news > TCL Oled TV (Ink-Jet Printed RGB): 55''/65' ' in 2025, 77''/85''/98'' in 2026?), could well reshuffle the cards and put Oled back in the spotlight with premium performance offered at an affordable price. However, we will have to wait at best until 2025 to see the first TVs based on this technology arrive, and probably one to two additional years to see their prices rival those of LCD Mini LED TVs. In the meantime, barring any surprises, the Oled TV segment should remain a (nice) niche market.