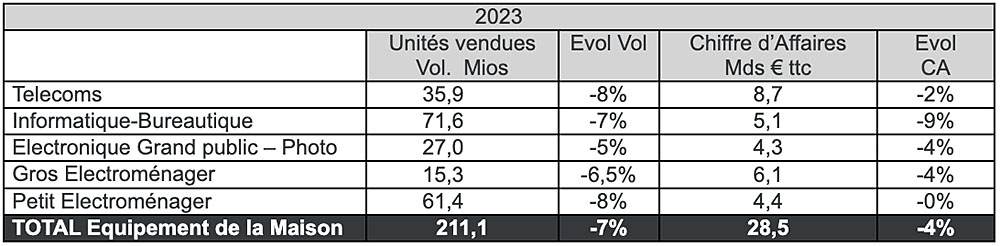

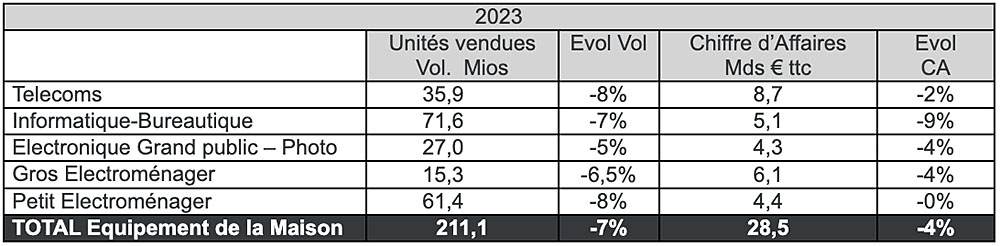

This is therefore the second time that the home equipment market has been bearish since 2020, the fault of an inflation rate remaining high in 2023 with the consequence of sluggish household consumption. And the situation is the same in Europe: Italy and Germany show a Home Equipment turnover of -5%, the United Kingdom is at -4%, only Spain is stable compared to its 2022 activity.

A word to Julien Peleton-Granier, GfK Consumer Intelligence consultant££££

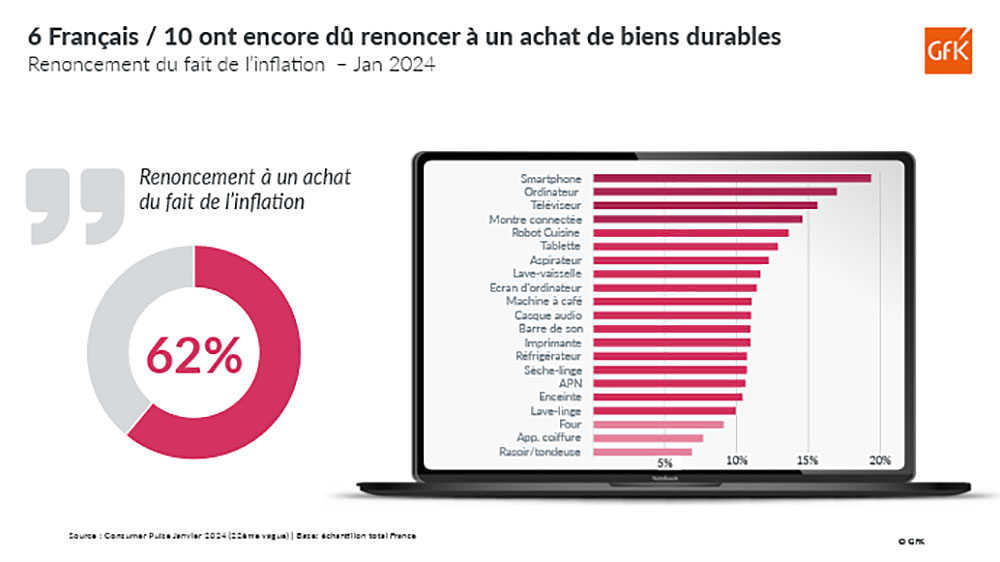

“The situation is still difficult for consumers: the context of multiple crisis has led them to be cautious and to reconsider some of their projects personal. For illustration, 9 out of 10 French people reduced their spending in 2023, all items combined (food, leisure, electronic devices, etc.) and 41% saw the situation in their household deteriorate in 2023 according to the latest GfK Consumer Pulse study - January 2024 , comments Julien Peleton-Granier, GfK Consumer Intelligence consultant. Among the other consequences, 1 in 3 real estate projects have been postponed, whether on the purchase/moving side or on the Kitchen Bathroom renovation side. These elements combined have a significant impact on sales of Home Equipment: 6 out of 10 French people have given up on purchasing durable goods in 2023.â€

The Telecom market 2023££££ Despite a declining turnover in 2023, -2% (see summary table of 2023 performances by market below), the Telecom market remains the most important of the goods technical, capturing 8.7 billion euros in telephone accessories and devices. The smartphone category unsurprisingly remains the locomotive of this market even if sales of new products are declining (13.6 million copies for 2023 at -13%). The overall value is relatively preserved thanks to an upscaling of consumers who no longer hesitate to invest in the most expensive models in order to use them for longer. The average price reached in 2023, excluding subsidies, 566 (+11%). Ultimately, the turnover of the Smartphone market only fell by -4% to 7.7 billion euros. Namely, reconditioned models represent less than 20% of sales, or 2.8 million devices, down slightly. For their part, sales of telecom accessories have experienced a boom linked to the new standards imposed by the 'European Union. Thus, 8.4 million chargers (+10%) and 1.9 million Powerbanks (+6%) were sold, for respective increases of +14% and +16%. Among the big losers in the Accessories market, Connected Watches and Trackers which experienced a drop in revenue. The IT-Office market 2023££££ The IT-Office sector looks gloomy in 2023 with the sharpest decline observed through a turnover of 5.1 billion euros, at - 9% (see summary table of 2023 performances by market below). Computer sales are falling sharply: turnover down -12% for laptops and -24% for desktop models. The monitor segment, however, is holding up, +10% in volumes and stable turnover at 0%, thanks to a drop in the average price. The Office sector shows a clear decline, except for SSDs (turnover up, +11%), IT headsets (+30%) which still benefit from the practice of teleworking, and Gaming accessories. French consumers spent 265 million euros (up +7%) on the purchase of keyboards, controllers, headsets and mice adapted to playing video games.

The EGP-Photo market 2023££££ Sales of consumer electronics/photo equipment also fell in 2023, by -4% (see summary table of 2023 performances by market above) to 4.3 Billions of Euro's. “The landing is relatively logical because the market is strongly influenced by television sales -37% of the sector's turnover- and in fact, international football competitions,†explains Pierre Geismar, Lead Tech & Durables at GfK. However, although the promotional activations around Rugby have been numerous, their impact on annual sales cannot be compared with a World Cup year. Thus the 2023 activity remains below 2022, with a Television turnover of €1.9 billion at -5%. Namely, within the TV market, the premium TV segment is growing, a little. The WCG Quantum and Oled/Qled LCD models are growing by +3% and +4% respectively. For your information, this segment represents almost 1 television purchased in 3 and 51% of the 2023 market turnover. The Photo market shows good dynamics, driven by an increase in sales volumes of hybrid digital devices (+17% ), children's cameras (+27%) and a clear recovery in Action Cams. The latter, after several really difficult years, are experiencing remarkable growth in turnover, between +15% and +20%. Good performance also from sales of EGP accessories with an increase of +2% in turnover, thanks only to Arceaux Bluetooth headsets whose sales grew by +16% in volume for a turnover of 219 million euros, at +22% . On the other hand, in the Hi-Fi and Audio segments, it's not the same beer. The first named ends 2023 with revenues down -9% in turnover: Bluetooth listening stations/speakers are down -8% in volume and -5% in value. For the second, on the audio side therefore, the market shows revenues still falling, -5%, with however some product families growing: Home Cinema Amplifiers/Receivers generate a turnover of 23 million euros, at +24% or still radio sets at +2% for a turnover of 25 million euros. The PEM/GEM 2023 market££££ A few words on the worlds of Small and Large Household Appliances (PEM/GEM), real pillars of the home equipment market to report that French consumers spent 10.4 billion euros in 2023, down slightly to -2%. The PEM sector is holding up, 4.4 billion euros at -0% in turnover (see summary table of 2023 performances by market above) while the GEM sector is down to 6.1 billion euros at -4% (see summary table of 2023 performances by market above), linked to the slowdown in the real estate market.