Adopted by almost all TV brands for their premium series, except for the leader Samsung, OLED technology has definitely made a name for itself in the premium TV market. However, the market share of White Oled technology is not as large as one might think. Explanations.

2019 to 2021, from 29% to 35% of OLED premium TV sales

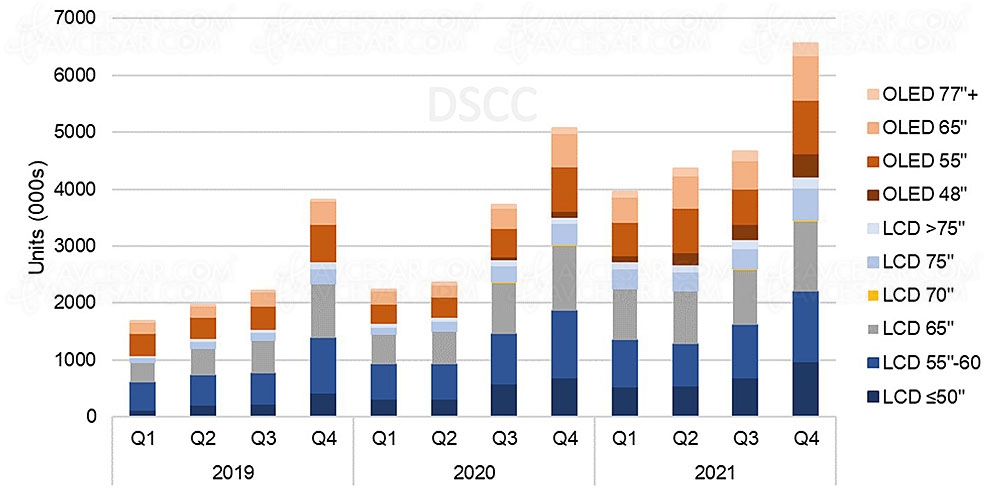

Before going further in the analysis of Oled TV vs LCD TV sales (see graph by screen size below), it should be noted that Oled models represented around 29% of TV sales in the fourth quarter of 2019 premium, then 31.4% in 2020 and 35% in 2021, always for the same period of course, which is the most favorable for television sales in the world. Especially in the absence of events of the Euro football or Olympic Games type, two major sporting events in 2020 postponed to 2021. And to be complete in our observations, we note that for the other quarters of this time period of three years, the year 2020 rich in confinements was rather favorable to LCD technology while 2021 saw a catch-up in favor of Oled.

The market share of LCD TVs boosted with Mini LEDs from 2021 and essentially defended by Samsung has therefore held up against the horde of OLED models offered by almost all the other TV brands (TCL is not fan of White Oled).

Why the LCD resists, why the Oled progresses slowly

To explain this situation, it is easy to put forward prices very largely in favor of LCD screens with equal diagonal compared to OLED specimens. Despite an erosion in prices throughout each of the last three years, Oled TVs are indeed still displayed significantly more expensive than their LCD counterpart. We can also mention the sharp increase in display quality of LCD televisions, Full LED Local Dimming in 2020 then Mini LED in 2021, in the field of black depth, a domain reserved for Oled. In addition, their ability to magnify an HDR signal with a light peak unmatched by OLED TVs secures them the favor of many consumers.

But there is an essential point to explain this moderate increase in the TV market share Oled, production capacities constrained because provided by a single manufacturer, LG Display. And this despite an increase of around 80% in the production of OLED TV panels in 2021 to 7.1 million units, compared to just under 4 million in 2020. In short, OLED is progressing slowly but surely… But slowly .

What about LCD and OLED premium TV market shares in 2022?

It now remains to be checked whether the increase in production planned by LG Display, 10 million Oled TV panels in 2022, associated with the arrival of Samsung on this market (with QD Oled panels signed Samsung Display from the month of May in Europe and North America, but also White Oled signed LG Display in the second half of 2022) will result in increased market share in the premium TV market. Or if LCD technology will always resist with, always, Samsung and its Neo QLED screens and perhaps other brands that could assert their ambition in this segment, TCL in the lead.