After having discussed at length during the CES show in Las Vegas with two colleagues, English and American, present at the end of 2023 at the premises of the manufacturer Sony in Tokyo for a demonstration of a Mini LED TV prototype from the brand planned for its 2024 range, we know more about the reasons which push Sony to now favor this display technology to the detriment of Oled.

Following your numerous questions on the rumors of Sony's abandonment of Oled technology (a subject that we have been following since the IFA show in Berlin during which we had the first rumors on this subject from Asian colleagues), We decided to investigate further in order to contextualize what appears to be an evolution of strategy on the part of Sony for its televisions, and not a radical change. Understand from this that the 2024 range will still include Oled TV references in its ranks but the flagship will no longer necessarily be an Oled model, at the very least the latter will share the role of locomotive with a Mini LED reference. Indeed, according to the latest news, the A95L series 2023 vintage (see photo below) would not be renewed in 2024. A way for the brand to still position Oled technology at the top of its range even if its efforts have been dedicated to Mini LED for 2024. Explanations.

Oled TV market, sudden brake in 2023££££ Remember, in one of our previous publications dedicated to the severe decline in the market Oled TV in 2023 (see our news Oled TV market 2023, from decline to fall (-24%)), we concluded our remarks with major strategic changes underway within the two main manufacturers of Oled TV panels, Samsung Display on the one hand and LG Display on the other, but also from their customers (we obtained, in Offline, some information on this subject as early as October). We have the perfect illustration of this with the new strategy implemented by Sony for its 2024 TV range which will focus on Mini LED and no longer Oled as in previous years (barring last minute surprises, industrialization problem of the new Sony Mini LED component for example). If the fall in the Oled TV market observed in 2023 and its less than enthusiastic 2024 prospects, while the Mini LED market segment is expected to double in volume from 7% market share in 2023 to 12%/15% in 2024, are not not the only elements in question, they nevertheless participate in Sony's decision to take a closer interest in Mini LED technology.

Professional market, the choice of Dual Cell LCD to the detriment of 'Oled££££ As has been said, Sony's choice to develop Mini LED for its premium TVs can be explained by several reasons. In addition to a sluggish dynamic in the Oled TV market segment, the fault of televisions offered at prices considered too expensive by consumers (especially in times of inflation), we must also mention the evolution of content creators who are increasingly more eager to use the new technologies made available to them. Among them, the emergence of HDR which is radically changing habits among image professionals. To the point that Sony Pro has abandoned the marketing of its Oled reference monitor, the BVM-HX310 with a light peak limited to 1,000 nits, with a Dual Cell LCD model (two LCD panels assembled to reinforce the blacks at the Oled level). ) featuring a peak light of 4,000 nits, the BVM-HX3110. Sony Pro is thus following the evolution of the intentions of directors and cinematographers who increasingly wish to benefit from 4,000 nits HDR mastering of their works. With an artistic concern first, with a concern for sustainability then in order to allow their future exploitation through numerous increasingly qualitative distribution channels (HDR compatible for example), 4K TNT being the latest with a notebook charges aimed at broadcasting up to HDR10 and Dolby Atmos. Obviously, this is impossible with an Oled monitor. This is why this technology is today irremediably and very quickly pushed out of professional studios. And Sony Electronics, anticipating the growing availability of works mastered at 4,000 nits, is therefore banking on the only technology capable of displaying such brightness without real constraints (available on a large screen area, for a significant period of time). time and not a few seconds…), the Mini LED.

Oled TV panel, Sony is subject to the pricing policy of its suppliers LG Display and Samsung Display££££ The cost of acquiring a broadcast by the consumer is another reason explaining Sony's choice to favor the development of Mini LED for 2024. For the same size and at least identical light specifications, but most often with the advantage of Mini LED, these televisions are much more accessible than their Oled counterparts, or even downright affordable. And if we add the growth in sales of 75†TVs and above, the war is lost for Oled. Indeed, the larger the diagonal of an Oled TV panel, the higher its production cost. LG Display, and to a lesser extent Samsung Display, have still not succeeded after more than ten years for the first named, almost three years for the other, to drastically lower the production costs of their Oled technology. Manufacturers of Oled TV panels therefore limit the size of their TV panels on the one hand, and the volume of the largest panels on the other, aware that diagonals beyond 77'' will be difficult to find buyers due to selling prices. too high, therefore little or no competition with Mini LED LCD TVs. Of course, on the LCD side the cost price of the panels is also dependent on the diagonal but to a significantly lesser extent. While the increase in the price of an LCD TV panel is proportional to the cost of the additional inch (10 inches to go from a 55'' to a 65'' for example), it is exponential on the Oled, especially on larger sizes. We must also keep in mind that competition is much fiercer on LCD TV panels thanks to many manufacturers, hence lower purchase prices for LCD TV panels compared to Oled ones where only LG Display and Samsung Display are present. . Mini LED technology, greater development potential than Oled?££££ Another interesting point, which appeared in our discussions with several engineers within the screen manufacturers themselves (the factories in South Korea, China and Taiwan) but also brands, the general development potential of Mini LED technology considered more important than that of Oled technologies available on the market, White Oled and QD Oled. Even if the latter still have room for progress (for example with the arrival of the phosphorescent blue emitter instead of the fluorescent emitter or the simplification of the structure of a TV panel), it would be limited compared to that of the Mini LED. In any case at a reasonable cost. An argument to be compared to the problem of the purchasing cost of consumers wishing to acquire increasingly larger TVs at an affordable price. Price elasticity remains high in the TV market, with only a small percentage of the world's population ready to pay a significant amount to afford a new television.

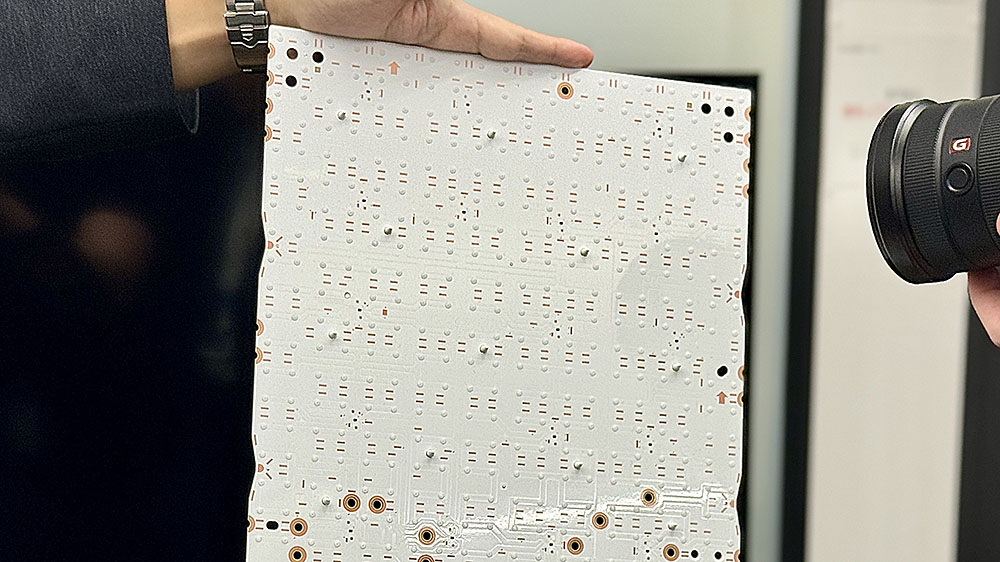

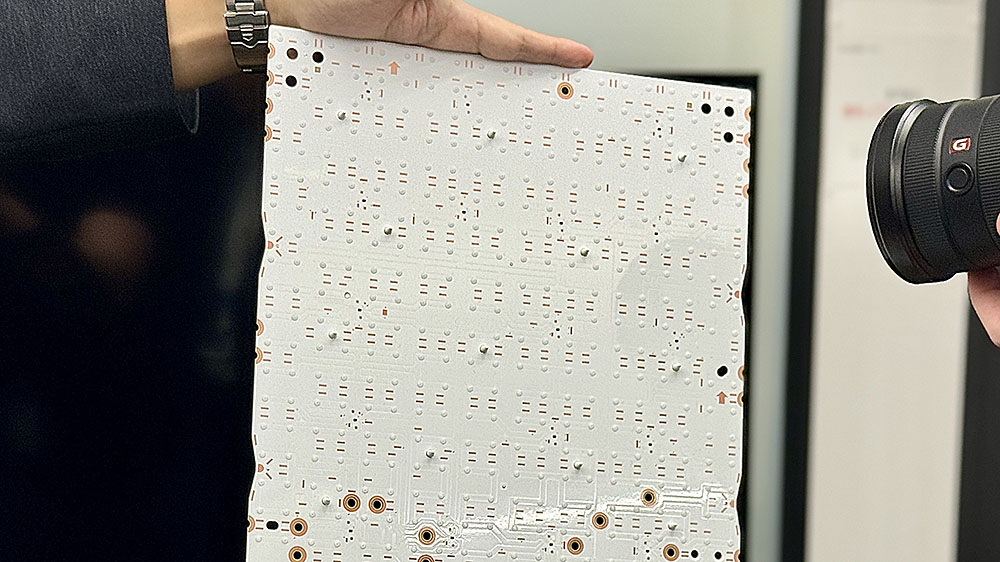

Sony Mini LED, new backlighting developed with the Sony Semiconductor Solutions Group division££££ Finally, there is another primary reason for the choice of Sony, the situation of the supply chain for Oled panels. Since the sale in 2011 of half of the S-LCD joint venture with Samsung, the Japanese manufacturer no longer has access to its TV panels. What is true for LCD is even more true for OLED. If Sony ensured in Japan until recently an anecdotal production of Oled RGB panels for its pro division (Oled monitors used within pro studios, mentioned above), the Japanese group is obliged to obtain supplies from Korean manufacturers LG Display and Samsung Display for its televisions. This lack of vertical integration greatly limits the value Sony adds to its televisions. Even if Sony is known for its excellent video processing, good design and certain audio capabilities, it remains difficult, for example, to differentiate a Samsung Oled TV from a Sony. In addition, Sony is subject to the commercial law of its suppliers and buys its Oled panels quite expensively. By making this change of foot, from Oled to Mini LED, and by developing its own backlighting system with the help of its division Sony Semiconductor Solutions Group (see photo above published by our colleagues at Tomsguide), Sony will increase its profitability. In fact, Sony will only purchase the Open Cell element, the sandwich cell made up of the layer of glass and liquid crystals, at a very competitive price. Sony then adds its backlighting. Ultimately, the cost price is significantly lower for an improved margin. Another advantage of the situation, Sony is master of the development of its backlighting, and therefore of its quality, an important asset allowing the Japanese firm's Mini LED LCD televisions to differentiate themselves more easily from its competitors equipped with the same Open Cell panels.

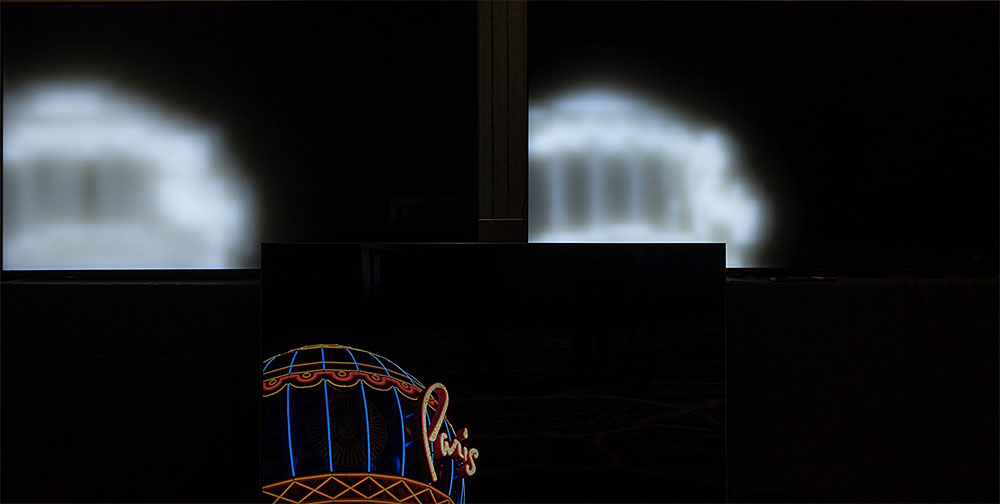

Sony Mini LED, new backlight with 22-bit controller££££ For your information, the Mini LED backlight prototype unveiled by Sony in Tokyo is equipped with an “in-house†22-bit LED controller, the most smallest in the world according to the Japanese manufacturer. In the bright areas of the image, Sony declares to ensure perfect control of contrasts by perfectly grading the energy sent to each LED for perfect gradients and sharper details (see photo below published by our Expertreviews colleagues). In addition, the new LED controller from Sony verifies that the LEDs always operate at their maximum potential, for each of the images displayed on the screen, by checking their perfect voltage (constant voltage) sensitive to the intensity of the current and the temperature. Thus, each of the LEDs always provides the perfect level of brightness requested by the processor. Ultimately, Sony is able with this new component to manage an increased number of zones for the same energy consumption. But the new Sony 22-bit LED controller also has improvements that benefit the black areas of the image by drastically lowering the current intensity of said areas where conventional Mini LED backlighting systems, if they display nothing in the black areas, however, consume as much energy as a lit area. In addition to these improvements, this new controller ensures strict control of consumption (by eliminating waste at all stages of the backlighting system) which, inevitably, appears significantly lower. This is also the verdict provided, during a demonstration displaying the same source on a 65'' Sony X85L 2023 Mini LED TV, a 65'' Sony A80L 2023 Oled TV (in photo below) and the prototype Mini LED 65'' 2024, by three wattmeters connected to the screens. The most frugal TV in this area was none other than the Mini LED 2024 prototype, in the presence of an HDR or SDR signal.

Last clarification, Sony should be very interested in the technology Ink-Jet Printed Oled RGB announced to be much less expensive to produce (see our CES 24 news > TV Oled TCL (Ink-Jet Printed RGB): 55''/65'' in 2025, 77''/85''/98 '' in 2026?). If, in addition to a lower cost price, the performances are there and capable of competing with them of the Mini LED (the latter will however have progressed well by the expected arrival of the first IJP Oled RGB TVs in 2025), the This trend could once again be reversed at Sony (and undoubtedly at others…). But the history of IJP Oled RGB technology remains to be written.

Oled TV market, sudden brake in 2023££££ Remember, in one of our previous publications dedicated to the severe decline in the market Oled TV in 2023 (see our news Oled TV market 2023, from decline to fall (-24%)), we concluded our remarks with major strategic changes underway within the two main manufacturers of Oled TV panels, Samsung Display on the one hand and LG Display on the other, but also from their customers (we obtained, in Offline, some information on this subject as early as October). We have the perfect illustration of this with the new strategy implemented by Sony for its 2024 TV range which will focus on Mini LED and no longer Oled as in previous years (barring last minute surprises, industrialization problem of the new Sony Mini LED component for example). If the fall in the Oled TV market observed in 2023 and its less than enthusiastic 2024 prospects, while the Mini LED market segment is expected to double in volume from 7% market share in 2023 to 12%/15% in 2024, are not not the only elements in question, they nevertheless participate in Sony's decision to take a closer interest in Mini LED technology.

Oled TV market, sudden brake in 2023££££ Remember, in one of our previous publications dedicated to the severe decline in the market Oled TV in 2023 (see our news Oled TV market 2023, from decline to fall (-24%)), we concluded our remarks with major strategic changes underway within the two main manufacturers of Oled TV panels, Samsung Display on the one hand and LG Display on the other, but also from their customers (we obtained, in Offline, some information on this subject as early as October). We have the perfect illustration of this with the new strategy implemented by Sony for its 2024 TV range which will focus on Mini LED and no longer Oled as in previous years (barring last minute surprises, industrialization problem of the new Sony Mini LED component for example). If the fall in the Oled TV market observed in 2023 and its less than enthusiastic 2024 prospects, while the Mini LED market segment is expected to double in volume from 7% market share in 2023 to 12%/15% in 2024, are not not the only elements in question, they nevertheless participate in Sony's decision to take a closer interest in Mini LED technology.  Professional market, the choice of Dual Cell LCD to the detriment of 'Oled££££ As has been said, Sony's choice to develop Mini LED for its premium TVs can be explained by several reasons. In addition to a sluggish dynamic in the Oled TV market segment, the fault of televisions offered at prices considered too expensive by consumers (especially in times of inflation), we must also mention the evolution of content creators who are increasingly more eager to use the new technologies made available to them. Among them, the emergence of HDR which is radically changing habits among image professionals. To the point that Sony Pro has abandoned the marketing of its Oled reference monitor, the BVM-HX310 with a light peak limited to 1,000 nits, with a Dual Cell LCD model (two LCD panels assembled to reinforce the blacks at the Oled level). ) featuring a peak light of 4,000 nits, the BVM-HX3110. Sony Pro is thus following the evolution of the intentions of directors and cinematographers who increasingly wish to benefit from 4,000 nits HDR mastering of their works. With an artistic concern first, with a concern for sustainability then in order to allow their future exploitation through numerous increasingly qualitative distribution channels (HDR compatible for example), 4K TNT being the latest with a notebook charges aimed at broadcasting up to HDR10 and Dolby Atmos. Obviously, this is impossible with an Oled monitor. This is why this technology is today irremediably and very quickly pushed out of professional studios. And Sony Electronics, anticipating the growing availability of works mastered at 4,000 nits, is therefore banking on the only technology capable of displaying such brightness without real constraints (available on a large screen area, for a significant period of time). time and not a few seconds…), the Mini LED.

Professional market, the choice of Dual Cell LCD to the detriment of 'Oled££££ As has been said, Sony's choice to develop Mini LED for its premium TVs can be explained by several reasons. In addition to a sluggish dynamic in the Oled TV market segment, the fault of televisions offered at prices considered too expensive by consumers (especially in times of inflation), we must also mention the evolution of content creators who are increasingly more eager to use the new technologies made available to them. Among them, the emergence of HDR which is radically changing habits among image professionals. To the point that Sony Pro has abandoned the marketing of its Oled reference monitor, the BVM-HX310 with a light peak limited to 1,000 nits, with a Dual Cell LCD model (two LCD panels assembled to reinforce the blacks at the Oled level). ) featuring a peak light of 4,000 nits, the BVM-HX3110. Sony Pro is thus following the evolution of the intentions of directors and cinematographers who increasingly wish to benefit from 4,000 nits HDR mastering of their works. With an artistic concern first, with a concern for sustainability then in order to allow their future exploitation through numerous increasingly qualitative distribution channels (HDR compatible for example), 4K TNT being the latest with a notebook charges aimed at broadcasting up to HDR10 and Dolby Atmos. Obviously, this is impossible with an Oled monitor. This is why this technology is today irremediably and very quickly pushed out of professional studios. And Sony Electronics, anticipating the growing availability of works mastered at 4,000 nits, is therefore banking on the only technology capable of displaying such brightness without real constraints (available on a large screen area, for a significant period of time). time and not a few seconds…), the Mini LED.  Oled TV panel, Sony is subject to the pricing policy of its suppliers LG Display and Samsung Display££££ The cost of acquiring a broadcast by the consumer is another reason explaining Sony's choice to favor the development of Mini LED for 2024. For the same size and at least identical light specifications, but most often with the advantage of Mini LED, these televisions are much more accessible than their Oled counterparts, or even downright affordable. And if we add the growth in sales of 75†TVs and above, the war is lost for Oled. Indeed, the larger the diagonal of an Oled TV panel, the higher its production cost. LG Display, and to a lesser extent Samsung Display, have still not succeeded after more than ten years for the first named, almost three years for the other, to drastically lower the production costs of their Oled technology. Manufacturers of Oled TV panels therefore limit the size of their TV panels on the one hand, and the volume of the largest panels on the other, aware that diagonals beyond 77'' will be difficult to find buyers due to selling prices. too high, therefore little or no competition with Mini LED LCD TVs. Of course, on the LCD side the cost price of the panels is also dependent on the diagonal but to a significantly lesser extent. While the increase in the price of an LCD TV panel is proportional to the cost of the additional inch (10 inches to go from a 55'' to a 65'' for example), it is exponential on the Oled, especially on larger sizes. We must also keep in mind that competition is much fiercer on LCD TV panels thanks to many manufacturers, hence lower purchase prices for LCD TV panels compared to Oled ones where only LG Display and Samsung Display are present. . Mini LED technology, greater development potential than Oled?££££ Another interesting point, which appeared in our discussions with several engineers within the screen manufacturers themselves (the factories in South Korea, China and Taiwan) but also brands, the general development potential of Mini LED technology considered more important than that of Oled technologies available on the market, White Oled and QD Oled. Even if the latter still have room for progress (for example with the arrival of the phosphorescent blue emitter instead of the fluorescent emitter or the simplification of the structure of a TV panel), it would be limited compared to that of the Mini LED. In any case at a reasonable cost. An argument to be compared to the problem of the purchasing cost of consumers wishing to acquire increasingly larger TVs at an affordable price. Price elasticity remains high in the TV market, with only a small percentage of the world's population ready to pay a significant amount to afford a new television.

Oled TV panel, Sony is subject to the pricing policy of its suppliers LG Display and Samsung Display££££ The cost of acquiring a broadcast by the consumer is another reason explaining Sony's choice to favor the development of Mini LED for 2024. For the same size and at least identical light specifications, but most often with the advantage of Mini LED, these televisions are much more accessible than their Oled counterparts, or even downright affordable. And if we add the growth in sales of 75†TVs and above, the war is lost for Oled. Indeed, the larger the diagonal of an Oled TV panel, the higher its production cost. LG Display, and to a lesser extent Samsung Display, have still not succeeded after more than ten years for the first named, almost three years for the other, to drastically lower the production costs of their Oled technology. Manufacturers of Oled TV panels therefore limit the size of their TV panels on the one hand, and the volume of the largest panels on the other, aware that diagonals beyond 77'' will be difficult to find buyers due to selling prices. too high, therefore little or no competition with Mini LED LCD TVs. Of course, on the LCD side the cost price of the panels is also dependent on the diagonal but to a significantly lesser extent. While the increase in the price of an LCD TV panel is proportional to the cost of the additional inch (10 inches to go from a 55'' to a 65'' for example), it is exponential on the Oled, especially on larger sizes. We must also keep in mind that competition is much fiercer on LCD TV panels thanks to many manufacturers, hence lower purchase prices for LCD TV panels compared to Oled ones where only LG Display and Samsung Display are present. . Mini LED technology, greater development potential than Oled?££££ Another interesting point, which appeared in our discussions with several engineers within the screen manufacturers themselves (the factories in South Korea, China and Taiwan) but also brands, the general development potential of Mini LED technology considered more important than that of Oled technologies available on the market, White Oled and QD Oled. Even if the latter still have room for progress (for example with the arrival of the phosphorescent blue emitter instead of the fluorescent emitter or the simplification of the structure of a TV panel), it would be limited compared to that of the Mini LED. In any case at a reasonable cost. An argument to be compared to the problem of the purchasing cost of consumers wishing to acquire increasingly larger TVs at an affordable price. Price elasticity remains high in the TV market, with only a small percentage of the world's population ready to pay a significant amount to afford a new television.  Sony Mini LED, new backlighting developed with the Sony Semiconductor Solutions Group division££££ Finally, there is another primary reason for the choice of Sony, the situation of the supply chain for Oled panels. Since the sale in 2011 of half of the S-LCD joint venture with Samsung, the Japanese manufacturer no longer has access to its TV panels. What is true for LCD is even more true for OLED. If Sony ensured in Japan until recently an anecdotal production of Oled RGB panels for its pro division (Oled monitors used within pro studios, mentioned above), the Japanese group is obliged to obtain supplies from Korean manufacturers LG Display and Samsung Display for its televisions. This lack of vertical integration greatly limits the value Sony adds to its televisions. Even if Sony is known for its excellent video processing, good design and certain audio capabilities, it remains difficult, for example, to differentiate a Samsung Oled TV from a Sony. In addition, Sony is subject to the commercial law of its suppliers and buys its Oled panels quite expensively. By making this change of foot, from Oled to Mini LED, and by developing its own backlighting system with the help of its division Sony Semiconductor Solutions Group (see photo above published by our colleagues at Tomsguide), Sony will increase its profitability. In fact, Sony will only purchase the Open Cell element, the sandwich cell made up of the layer of glass and liquid crystals, at a very competitive price. Sony then adds its backlighting. Ultimately, the cost price is significantly lower for an improved margin. Another advantage of the situation, Sony is master of the development of its backlighting, and therefore of its quality, an important asset allowing the Japanese firm's Mini LED LCD televisions to differentiate themselves more easily from its competitors equipped with the same Open Cell panels.

Sony Mini LED, new backlighting developed with the Sony Semiconductor Solutions Group division££££ Finally, there is another primary reason for the choice of Sony, the situation of the supply chain for Oled panels. Since the sale in 2011 of half of the S-LCD joint venture with Samsung, the Japanese manufacturer no longer has access to its TV panels. What is true for LCD is even more true for OLED. If Sony ensured in Japan until recently an anecdotal production of Oled RGB panels for its pro division (Oled monitors used within pro studios, mentioned above), the Japanese group is obliged to obtain supplies from Korean manufacturers LG Display and Samsung Display for its televisions. This lack of vertical integration greatly limits the value Sony adds to its televisions. Even if Sony is known for its excellent video processing, good design and certain audio capabilities, it remains difficult, for example, to differentiate a Samsung Oled TV from a Sony. In addition, Sony is subject to the commercial law of its suppliers and buys its Oled panels quite expensively. By making this change of foot, from Oled to Mini LED, and by developing its own backlighting system with the help of its division Sony Semiconductor Solutions Group (see photo above published by our colleagues at Tomsguide), Sony will increase its profitability. In fact, Sony will only purchase the Open Cell element, the sandwich cell made up of the layer of glass and liquid crystals, at a very competitive price. Sony then adds its backlighting. Ultimately, the cost price is significantly lower for an improved margin. Another advantage of the situation, Sony is master of the development of its backlighting, and therefore of its quality, an important asset allowing the Japanese firm's Mini LED LCD televisions to differentiate themselves more easily from its competitors equipped with the same Open Cell panels.  Sony Mini LED, new backlight with 22-bit controller££££ For your information, the Mini LED backlight prototype unveiled by Sony in Tokyo is equipped with an “in-house†22-bit LED controller, the most smallest in the world according to the Japanese manufacturer. In the bright areas of the image, Sony declares to ensure perfect control of contrasts by perfectly grading the energy sent to each LED for perfect gradients and sharper details (see photo below published by our Expertreviews colleagues). In addition, the new LED controller from Sony verifies that the LEDs always operate at their maximum potential, for each of the images displayed on the screen, by checking their perfect voltage (constant voltage) sensitive to the intensity of the current and the temperature. Thus, each of the LEDs always provides the perfect level of brightness requested by the processor. Ultimately, Sony is able with this new component to manage an increased number of zones for the same energy consumption. But the new Sony 22-bit LED controller also has improvements that benefit the black areas of the image by drastically lowering the current intensity of said areas where conventional Mini LED backlighting systems, if they display nothing in the black areas, however, consume as much energy as a lit area. In addition to these improvements, this new controller ensures strict control of consumption (by eliminating waste at all stages of the backlighting system) which, inevitably, appears significantly lower. This is also the verdict provided, during a demonstration displaying the same source on a 65'' Sony X85L 2023 Mini LED TV, a 65'' Sony A80L 2023 Oled TV (in photo below) and the prototype Mini LED 65'' 2024, by three wattmeters connected to the screens. The most frugal TV in this area was none other than the Mini LED 2024 prototype, in the presence of an HDR or SDR signal.

Sony Mini LED, new backlight with 22-bit controller££££ For your information, the Mini LED backlight prototype unveiled by Sony in Tokyo is equipped with an “in-house†22-bit LED controller, the most smallest in the world according to the Japanese manufacturer. In the bright areas of the image, Sony declares to ensure perfect control of contrasts by perfectly grading the energy sent to each LED for perfect gradients and sharper details (see photo below published by our Expertreviews colleagues). In addition, the new LED controller from Sony verifies that the LEDs always operate at their maximum potential, for each of the images displayed on the screen, by checking their perfect voltage (constant voltage) sensitive to the intensity of the current and the temperature. Thus, each of the LEDs always provides the perfect level of brightness requested by the processor. Ultimately, Sony is able with this new component to manage an increased number of zones for the same energy consumption. But the new Sony 22-bit LED controller also has improvements that benefit the black areas of the image by drastically lowering the current intensity of said areas where conventional Mini LED backlighting systems, if they display nothing in the black areas, however, consume as much energy as a lit area. In addition to these improvements, this new controller ensures strict control of consumption (by eliminating waste at all stages of the backlighting system) which, inevitably, appears significantly lower. This is also the verdict provided, during a demonstration displaying the same source on a 65'' Sony X85L 2023 Mini LED TV, a 65'' Sony A80L 2023 Oled TV (in photo below) and the prototype Mini LED 65'' 2024, by three wattmeters connected to the screens. The most frugal TV in this area was none other than the Mini LED 2024 prototype, in the presence of an HDR or SDR signal.  Last clarification, Sony should be very interested in the technology Ink-Jet Printed Oled RGB announced to be much less expensive to produce (see our CES 24 news > TV Oled TCL (Ink-Jet Printed RGB): 55''/65'' in 2025, 77''/85''/98 '' in 2026?). If, in addition to a lower cost price, the performances are there and capable of competing with them of the Mini LED (the latter will however have progressed well by the expected arrival of the first IJP Oled RGB TVs in 2025), the This trend could once again be reversed at Sony (and undoubtedly at others…). But the history of IJP Oled RGB technology remains to be written.

Last clarification, Sony should be very interested in the technology Ink-Jet Printed Oled RGB announced to be much less expensive to produce (see our CES 24 news > TV Oled TCL (Ink-Jet Printed RGB): 55''/65'' in 2025, 77''/85''/98 '' in 2026?). If, in addition to a lower cost price, the performances are there and capable of competing with them of the Mini LED (the latter will however have progressed well by the expected arrival of the first IJP Oled RGB TVs in 2025), the This trend could once again be reversed at Sony (and undoubtedly at others…). But the history of IJP Oled RGB technology remains to be written.